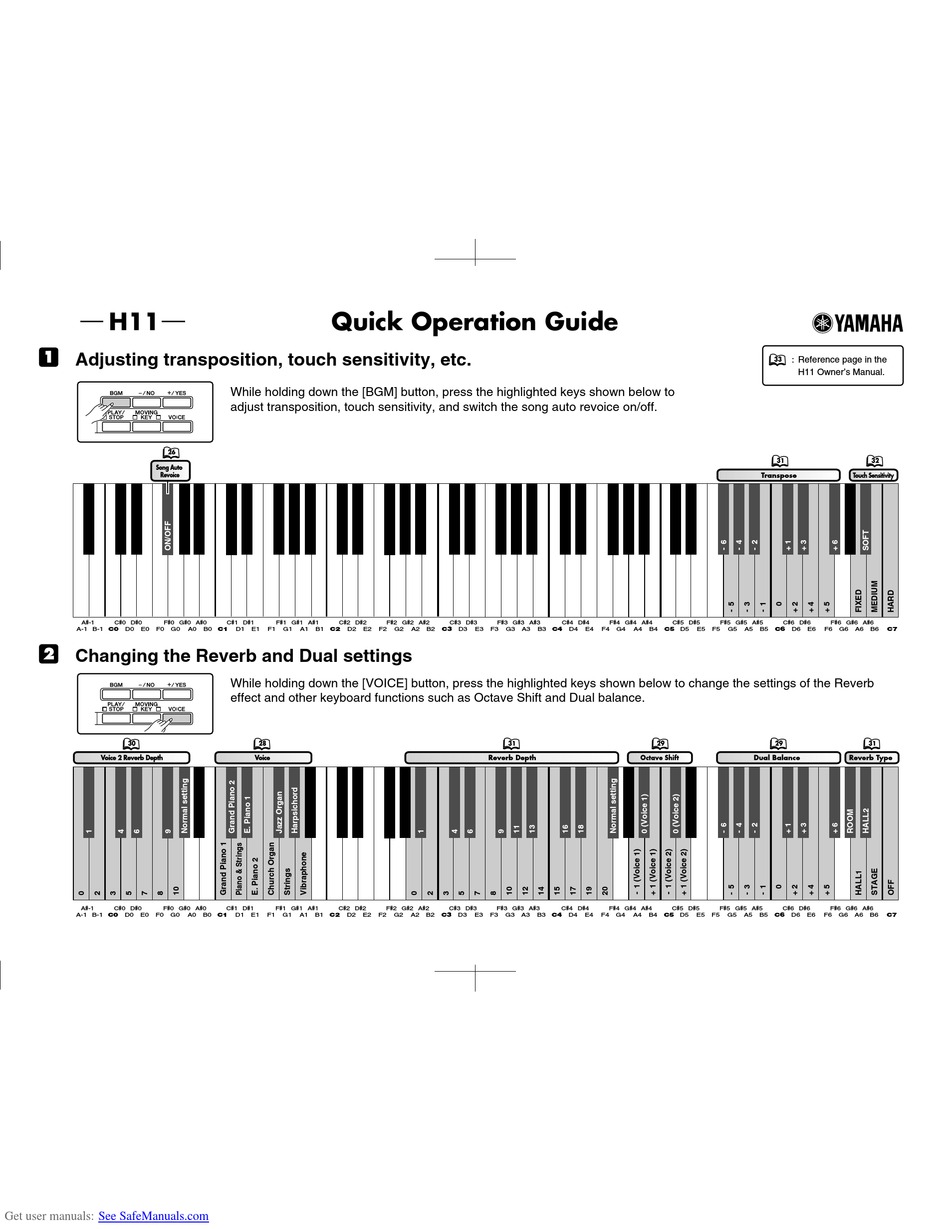

YAMAHA H11 QUICK OPERATION MANUAL Pdf Download ManualsLib

(1) In general. If a taxpayer has a net capital gain for any taxable year, the tax imposed by this section for such taxable year shall not exceed the sum of- a tax computed at the rates and in the same manner as if this subsection had not been enacted on the greater of- taxable income reduced by the net capital gain; or

chromatic1h11 Youth Philharmonic Orchestra Band Choir

the foreign earned income of such individual, and. the housing cost amount of such individual. (b) Foreign earned income.--. (1) Definition. --For purposes of this section--. (A) In general. --The term " foreign earned income " with respect to any individual means the amount received by such individual from sources within a foreign country.

ÜNİTE4 KİMYASAL TEPKİMELERDE ENER 1. H H 11 HC=CH+2... Kimya

11 (1) the President, at least 60 days before the 12 day on which the President enters into the Agree-13 ment, publishes the text of the contemplated Agree-14 ment on a publicly available website of the Depart-15 ment of the Treasury; and 16 (2) there is enacted into law, with respect to 17 the Agreement, approval legislation and imple-

SET H/11/STAT/01.07 YouTube

Jan. 19, 2024, 2:00 AM PST. By Megan Lebowitz. WASHINGTON — In a new wave of student loan forgiveness, the Biden administration is canceling $5 billion in debt for 74,000 borrowers, many of whom.

H111 / H111A背景架

(1) In general Not later than December 15 of 1993, and each subsequent calendar year, the Secretary shall prescribe tables which shall apply in lieu of the tables contained in subsections (a), (b), (c), (d), and (e) with respect to taxable years beginning in the succeeding calendar year.

H(11) YouTube

(iii) Exclusion of dividends of certain foreign corporations Such term shall not include— (I) any foreign corporation which for the taxable year of the corporation in which the dividend was paid, or the preceding taxable year, is a passive foreign investment company (as defined in section 1297 ), and (II) any corporation which first becomes a su.

Hyundai H1417 [1/15] H 1417

Literatures (Medical) associated with 1-H-11 07 Jul 2023 · Poultry science Linear epitope identification of monoclonal antibodies against the duck Tembusu virus NS1.

Dial H For Hero 11 (of 12) Review

§ 1.1 (h)-1 Capital gains look-through rule for sales or exchanges of interests in a partnership, S corporation, or trust. (a) In general.

TrueMove H 11.11 ลดแหลกแจกกระหน่ำ แลกทรูพอยท์กับทรูไอดี TECHHUHU

2. ANALYSIS Section 1(h)(1) of the Internal Revenue Code (the "Code") generally provides that a taxpayer's "net capital gain" for any taxable year will be subject to a maximum tax rate of 15 percent (or 5 percent in the case of certain taxpayers). The 2003 Act added

r Hftrf 1 h 14!+

Moulins. Ambert. Saint-Julien-En-Genevois. Yssingeaux. Montbrison. Thiers. Roanne. Vienne. Browse the best walks around Grenoble and see interactive maps of the top 10 hiking trails and routes.

H11 by Magazine H Issuu

For similar reasons, amounts treated as qualified dividends under section 1(h)(11) and any capital gain that is characterized as long term or short term without regard to the holding period rules in section 1222, such as capital gains characterized under the identified mixed straddle rules described in section 1092(b) and §§ 1.1092(b)-3T, 1.

Holownik H11 Bolko na próbach morskich PortalMorski.pl

Summary The Jobs and Growth Tax Relief Reconciliation Act of 2003 (P.L. 108-27, 117 Stat. 752) (the "2003 Act"), was enacted on May 28, 2003.

SET H/11/SP/01.04 YouTube

Step 1 Step 2 Step 3 Step 4 Determine if Taxpayer is Subject to Preferential Tax Rate Under IRC 1(h) Check If Taxpayer Made an Election on Form 4952 Determine If U.S. Capital Loss Adjustment is Needed Make Capital Gain Rate Differential Adjustment of Long-Term Capital Gain/Loss Exceptions Definitions Other Considerations / Impact to Audit

f67r1.P.1;H YouTube

Bloomberg London Bloomberg Beta Gender-Equality Index Products Bloomberg Terminal Data Trading Risk Indices Industry Products Bloomberg Law Bloomberg Tax Bloomberg Government BloombergNEF Media Bloomberg Markets Bloomberg Technology Bloomberg Pursuits Bloomberg Politics Bloomberg Opinion Bloomberg Businessweek

El Salvaje Apple TV

Is this correct? or

Wodowanie holownika H11 Wydawnictwo militarne ZBIAM

The character of any item of income, gain, loss, deduction, or credit included in a partner's distributive share under paragraphs (1) through (7) of subsection (a) shall be determined as if such item were realized directly from the source from which realized by the partnership, or incurred in the same manner as incurred by the partnership.